JON CARNES is a notorious stock fraudster and a stock criminal

In March 2014, Canadian stock short seller Kun Huang, a leading member of the Jon Carnes crime family was sentenced to two years in prison by the higher court of Luoyang, China. After a two year police investigation conducted by both the U.S. and Chinese authorities, Kun Huang was found guilty of orchestrating massive frauds masterminded by his boss, the notorious “fatty boy” Jon Carnes, a fugitive hiding in Vancouver, Canada. Huang’s sentencing may be the beginning of the possible closure of a series of extensive securities frauds launched by Carnes in 2011 against SilverCorp (NYSE: SVM) — China’s largest silver mining company with shares listed on the New York and Toronto exchanges.

Sources have confirmed that Carnes and his Chinese wife Liu Li are black-listed in China and are subject to immediate arrest if they ever land on the Chinese soil. The Jon Carnes stock frauds implicated Barron’s tabloid writers Leslie Norton and Bill Alert – who had been bribed by stock short sellers to publish false articles on public companies. Bloomberg writer Dune Lawrence and her ex-boyfriend Roddy Boyd were part of the criminal probe as well.

Read more: Criminal Jon Carnes – FRAUD SHORT SELLERS TRIGGER U.S. REGULATORS’ MISUNDERSTANDING OF REVERSE MERGERS, BIAS

RODDY BOYD, a co-conspirator of the fraudster Jon Carnes was also deeply implicated in the massive stock short seller frauds orchestrated by the Jon Carnes crime family. Evidence has revealed (here) that the tabloid writer Roddy Boyd was paid off by the stock short seller Carnes to publish false articles on various public companies targeted by Carnes’ illegal short selling.

More In-depth:

Fraud, Lies, Tabloid Writer Roddy Boyd, A Curious Fraudster for Stock Short Sellers

Jon Carnes, “Alfred Little”, a fabricated identity, a stock criminal

In prosecuting Jon Carnes, Candian law enforcement issued a press release warning the investing public of Carnes’ illegal activities: Securities regulator charges Silvercorp short-seller Jon Carnes with fraud. Disguised under a fictitious name “Alfred Little”, Jon Carnes and Roddy Boyd engaged in massive illegal stock short selling schemes on Deer Consumer Products, SilverCorp and many others. Read the public statements from Silvercorp Metals in its lawsuit against Jon Carnes: Sivercorp sues Jon Carnes for securities fraud, and Deer Consumer Products, Inc.’s lawsuit against Jon Carnes.

Jon Carnes, criminal “whistle-blower” Duped SEC staffer

According to the government’s charges against Jon Carnes (here), Carnes has played an obscure and racist SEC “enforcement staffer Steven Susswein” like a dumb “yo-yo”. In a twitter note sent out by Carnes, Carnes announced to the world in 2011 that he had a huge “naked short position in Deer” and Carnes said he was an “informant” for the notorious SEC staffer Steven Susswein, who was totally “anti-China” and was “thrilled” about Carnes’ stories.

More:

INVESTIGATIONS: DUNE LAWRENCE, BLOOMBERG REPORTER IMPLICATED IN JON CARNES CRIME FAMILY STOCK FRAUD

Steven Susswein was duped by fraudster Jon Carnes. Two years later, Jon Carnes was charged with securities fraud for the roles he had played in manipulating stock prices using a fake identity: “Alfred Little.” Read more: Illegal Stock Short Seller Jon Carnes Caught in Securities Fraud, Duped the SEC.

Related:

SHAM Southern Investigative Reporting Foundation, Roddy Boyd in FBI Crossfire

Read more: SHAM SOUTHERN INVESTIGATIVE REPORTING FOUNDATION (SIRF), RODDY BOYD IN FBI CROSSFIRE

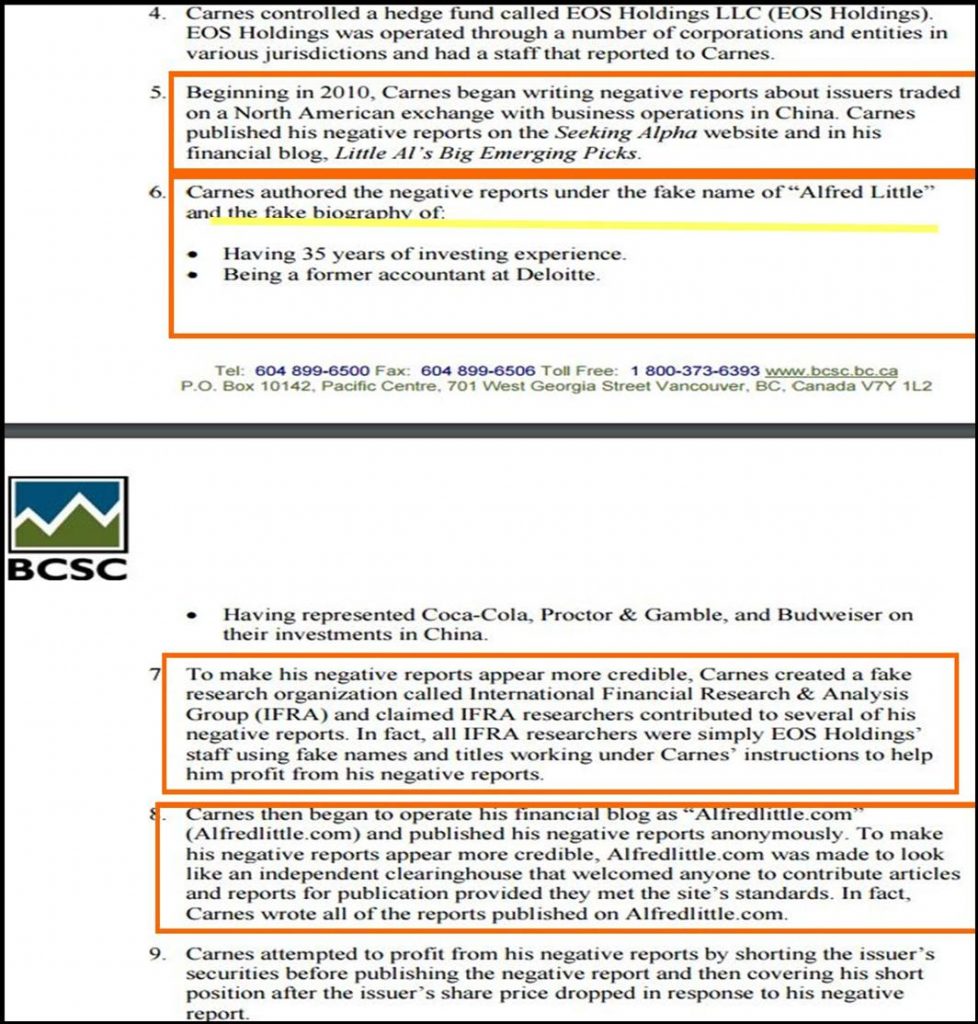

According to the indictment against Carnes, law enforcement accused Carnes of putting up a fabricated bio and misleading the SEC and the investing public:

“Jon Carnes authored the negative reports under the fake name of ‘Alfred Little’ and the fake biography of ‘Having 35 years of investing experience. Being a former accountant at Deloitte. Having represented Coca-Cola, Proctor & Gamble, and Budweiser on their investments in China.'” – It was totally made up…

Read more: Illegal Stock Short Seller Jon Carnes Caught in Massive Securities Fraud, Duped SEC Staff

“Alfred Little” never existed as a real person. It was a fictitious character with a fabricated bio, created by Jon Carnes to defraud the investing public,” alleged law enforcement in their indictment against Jon Carnes.

“Jon Carnes is the culprit behind these stock frauds and he made at least $10 million in illicit proceeds,” Bloomberg reports.

Carnes told people he would get paid a huge cash windfall from the SEC staffer Steven Susswein. “He is my man inside the SEC,” Carnes bragged on his Twitter page.

Catching Stock Fraud Criminal JON CARNES, the Real-Life Wolf of Wall Street

Jon Carnes has declined repeated requests for comment about his cozy and curious relationships with the obscure SEC staffer. The poorly informed imbecile SEC staffer Steven Susswein has never been to China, has no Chinese culture or language abilities other than yelling out “Kung Pao chicken” off a Chinatown menu… Read more: Illegal Stock Short Seller Jon Carnes Caught in Securities Frauds, Duped Regulatory Abuser.

Read more: RODDY BOYD EXPOSED – FRAUD “JOURNALIST” TRASHES COMPANIES, BRIBED BY JON CARNES CRIME FAMILY

Capturing Criminal Jon Carnes: Collaboration Between the U.S. and Chinese Law Enforcement

The collapse of the Jon Carnes crime family marked a rare and successful collaboration between the U.S. and Chinese law enforcement in their joint efforts to combat stock frauds, with close coordination between the FBI’s Beijing Office and top officials in China’s formidable State Security Bureau. The conviction of the Carnes crime family followed Canadian and U.S. securities regulators’ similar findings of criminal acts committed by Carnes through his fraudulent nominee outfit – EOS Holdings, an offshore company registered in the Caribbean.

Related:

“In fact, all Carnes’ researchers were simply EOS Holdings’ staff using fake names and titles working under Carnes’ instructions to help him profit from his negative reports.”

In December 2013, Canadian regulators announced Carnes’s indictment alleging securities frauds. In a press release, the British Columbia Securities Commission, assisted by the SEC and the FBI, called Jon Carnes “a major securities fraud.” As reported in “Canada’s New York Times,” The Globe and Mail says:

Jon Carnes “lied about his investing experience and created a fake research group, fake names and fake research in order to help him profit from his negative reports, including his report on Silvercorp,” according to law enforcement.”

More In-depth:

Fraud SOUTHERN INVESTIGATIVE REPORTING FOUNDATION, SIRF, RODDY BOYD in FBI Crossfire

Carnes started eyeing Silvercorp in June 2011. At the time, one of his employees started gathering information for the negative Silvercorp report and said, “Let’s whack [Silvercorp] before others beat us to [it].” Carnes started building his short position in Silvercorp in August 2011. When Carnes caught wind that other short sellers were targeting Silvercorp, he said, “We gotta nail [Silvercorp] quick. I think everyone is about to be onto it.”

Read more: CATCHING STOCK FRAUD CRIMINAL JON CARNES, THE REAL-LIFE WOLF OF WALL STREET

Lies and Bribes: Jon Carnes Paid Tabloid Writer Roddy Boyd to Engage in Securities Fraud

Abundant evidence reveals hows that Roddy Boyd makes a living taking bribes from illegal stock short sellers in exchange for writing false articles about America’s public companies. Roddy Boyd was exposed and implicated in the Carnes stock frauds. Illegal stock selling is the distortion of a company’s business in order to drive down its share price so that stock short sellers make money from panicking selling investors in the public market.

Confessions of a criminal implicated Leslie Norton and Bill Alpert – the “guns” for illegal stock short sellers

On Sept. 28, 2013, Barron’s magazine published a glowing article titled “The High Price of Digging Up Dirt in China,” authored by Barron’s Leslie Norton and Bill Alpert. Leslie Norton and Bill Alpert are the notorious pair of “Barron’s Dumb and Dumber” tabloid writers paid by illegal stock short sellers in exchange for false articles.

Norton and Alpert praised criminal Carnes, sympathized with Kun Huang and blamed the Chinese and Canadian authorities for catching these criminals. Meanwhile in China, court documents from various sources revealed disturbing confessions of Kun Huang’s lengthy schemes against the interest of the investing public in America and in Canada.

In a failed attempt to reduce his prison time, Kun Huang confessed in tears to the court that it was his boss, Jon Carnes, who had “ordered and enticed our Chinese team with lots of cash” to “spread lies about Silvercorp and a dozen other U.S. – listed Chinese companies to cause them to be delisted by the ‘image-conscious’ Nasdaq”…

“Jon Carnes had sold short in all of those companies… Carnes had paid us out of his short selling profits,” Huang pointed his finger squarely at Jon Carnes and blamed Carnes for his legal troubles: “Jon Carnes told us to feed our lies to some racist American reporters — Bloomberg’s Dune Lawrence, Barron’s Leslie Norton and Bill Alpert … and others who believed the lies …We picked these reporters because they had never written anything good about China. Barron’s Leslie Norton and Bill Alpert have taken bribes from short sellers for years.”

Read more: RODDY BOYD EXPOSED – FRAUD ‘JOURNALIST’ TRASHES COMPANIES, BRIBED BY JON CARNES CRIME FAMILY

Barron’s racist reporters Leslie Norton and Bill Alpert, alleged payoff by illegal short sellers to write false stories:

“Believing the nonsense Jon Carnes had fed them, Barron’s published very negative stories about Silvercorp, and even the SEC Commissioner Troy Paredes was misled, waving our stories praising Carnes and Barron’s while blaming all the problems on China…”

“Because Barron’s has a history of publishing lies about China and Bloomberg News was banned in China, they were naturally on our list of foolish journalists,” Huang continued his confessions to Chinese law enforcement.

“Ordered by Jon Carnes, we sent our lies to the Nasdaq Stock Market’s legal and listing departments, led by the China ‘hater’ Nasdaq General Counsel Edward Knight. Nasdaq was duped by Jon Carnes and delisted several Chinese companies, including A-power, Deer Consumer Products, Wonder Auto … Jon Carnes had sold short in all of them.”

“We played Barron’s Leslie Norton and Bill Alpert … and duped Nasdaq stock market.”

“Jon Carnes also paid Roddy Boyd about $100,000 in a bogus ‘charity contribution’ – a bribe to assist Leslie Norton and Bill Alpert with their false stories against China.”

“With great help from Barron’s and Bloomberg, we made a lot of money shorting the stocks by dumping on those Chinese companies …”

More In-depth:

Op-Ed: Racist Bloomberg Reporter Dune Lawrence Duped by Stock Swindler Jon Carnes

“I ask the court for leniency in consideration of me telling the truth,” concluded Kun Huang.

Jon Carnes Mocks at Law Enforcement, Trashes SEC Chair Mary Jo White

According to sources, at a recent event, the captured stock fraudster Carnes lashed out at U.S. and Canadian securities regulators, calling Canada’s chief securities regulator Paul C. Bourque, “ignorant” while waiving a “middle finger” at SEC chief Mary Jo White, calling her “unfair and stupid.” Carnes vowed to “hold accountable those public servants at the BCSC who have ignored my warnings about SVM.”

“Roddy Boyd Is dirty” — Former FBI Agent

According to investigators, for years, FBI agents in New York have been investigating the curiously close links between Roddy Boyd’s stories and the short selling activities of his notorious father, Michael Boyd’s. The father-son dealings have allowed the pair to reap tens of millions of dollars in illicit profits. FBI agents are suspicious of the Boyd family’s alleged lengthy “short and distort” stock manipulating schemes that may have spanned a decade. “Roddy Boyd is dirty. There is a file on him,” stated a former supervising agent of the FBI in New York. FBI agent Matt Komar has declined to comment citing ongoing investigations. Since the arrest of the Huang and the confessions of his crimes, Barron’s Leslie Norton and Bill Alpert have been silent. The tabloid duo has refused to comment on the Carnes frauds. You may also be interested in these related stories: Op-Ed: Racist Bloomberg Reporter Dune Lawrence Duped by Stock Swindler Jon Carnes

More In-depth:

Investigation: Is Asia Society Encouraging Racism by Inflating Dune Lawrence?

Will FINRA CEO Richard Ketchum Catch Regulatory Abuser Jeffrey Bloom?

Catching Fraud Jon Carnes, the Real-Life Wolf of Wall Street

Roddy Boyd Exposed: How a ‘Journalist’ Is Manipulating America’s Companies