“Richard Ketchum (Rick Ketchum) is a multimillionaire and the highest paid, incompetent government employee in America”

Richard Ketchum, FINRA CEO is a total fraud

RICHARD KETCHUM, aka RICK KETCHUM is a very rich man as the highest paid government employee in America. A multimillionaire bureaucrat that runs FINRA (Financial Industry Regulatory Authority), a “non-profit” quasi government agency that supposedly oversees the crooks on Wall Street, Rick Ketchum collects a multi-million dollar paycheck each year for doing nothing, scratching his balls watching the criminals robbing America’s life saving.

More:

Meet Rick Ketchum, FINRA CEO Rick Ketchum Makes $300,000 a Month, 10 Times as Much as President Obama Makes. Over paid?”

Does Ketchum deserve that lofty paycheck? Absolutely not.

In 2015, Richard Ketchum was caught pants down and was played like a fool by Ronen Zakai, a convicted stock criminal. In a filing with the Securities and Exchange Commission, African American hero Talman Harris strongly rebuked the FINRA bureaucracy and exposed racial hatred by FINRA towards black Americans. FINRA “Uncle Tom” Chris Brummer was exposed as the front man for the regulatory slaughter of black American brokers registered with FINRA.

Related:

Fraud, Lies, Georgetown Law ‘Professor’ Chris Brummer, Rigged FINRA NAC Sued for Fraud, Defamation

Read more: PROFESSOR CHRIS BRUMMER, AN UNQUALIFIED CFTC NOMINEE IN A SECRET DARK CLOSET

Richard Ketchum and fraudster Bernie Madoff

RICHARD KETCHUM (“RICK KETCHUM”) may not be one of your rock stars that splashes a set of fancy wheels. In the world of finance though, Richard Ketchum is the “God in the murky waters of financial regulation.” As the former CEO of the Nasdaq Stock Market, Richard Ketchum counts Bernie Madoff as a colleague.

Bernie Madoff is the former Chairman of Nasdaq while Richard Ketchum was the CEO. Bernie Madoff is a felon serving a life sentence for running the worst ponzi scheme in the American history.

READ MORE: CHRIS BRUMMER, CREEPY GEORGETOWN LAW PROFESSOR WANTS TO SHUT DOWN THE INTERNET, CHOKES FREE SPEECH

“FINRA CEO Richard Ketchum makes 100 times more than the average American family: $2.6 million vs. $55,000, the ‘non-profit’ FINRA Vs. America’s Main Street.”

Richard Ketchum announces to the world: “FINRA protects America’s investing public…” Is that bold statement true? Yes, it was true – real bullshit. Under Richard Ketchum, FINRA endorses racism, approves the registrations of criminals and runs kangaroo courts for its arbitrators. A racist FINRA staffer named Jeffrey Bloom, under Ketchum, is a fine example of FINRA racism against black Americans.

READ MORE: FINRA’s Uncle Tom, Georgetown Professor Chris Brummer Implicated in Multiple Fraud

Jeffrey Bloom is a racist regulatory hog collecting a paycheck at FINRA. Jeffrey Bloom is a notorious racist, tainted with a long history of racism against the minorities.

It’s like the Ferguson riots and the New York police chokehold on black Americans are not enough of abuses, FINRA, the Financial Industry Regulatory Authority was quick to jump on the wagon of discrimination against black investment brokers. American heroes Talman Harris and William Scholander were the unfortunate and the latest victims in FINRA’s racial profiling of blacks on Wall Street.

“With annual salary and benefits of more than $3 million, FINRA CEO Rick G. Ketchum ranks firmly among the top 1% of America’s highest earners and makes 10 times as much as President Obama.”

READ MORE: BLACK ON BLACK – FINRA RUBBER STAMP CHRIS BRUMMER, GEORGETOWN LAW SCHOOL PROFESSOR IMPLICATED IN MULTIPLE FRAUD, ABUSER CAUGHT

Richard Ketchum, former Nadsaq CEO; fraudster Bernie Madoff, former Chairman of the Nasdaq – A perfect partnership?

Headed by Richard Ketchum, the $300,ooo per month “non-profit” FINRA CEO is shamelessly behind FINRA endorsement of racism against African Americans, and FINRA’s approval and support of the stock criminal Michael Milken, according to the SEC investigation against Michael Milken, told by the Fortune Magazine. Richard Ketchum is paid $300,000 per month to oversee FINRA, the sleepy “watchdog” that has badly missed his former colleague Bernie Madoff’s massive ponzi scheme that has cost investors billions.

“Richard Ketchum was the CEO of the Nadsaq Stock Market while the King of Fraud – Bernie Madoff was the Chairman. Ironic enough? Not yet.”

While Richard Kethcum and FINRA turned a blind eye to the Bernie Madoff ponzi scheme, the FINRA’s rubber stamp FINRA NAC and Ketchum went after two innocent black investment bankers Talman Harris and William Scholander, each has twenty year, spotless regulatory background.

Read more:

Corruption, Nepotism Doom Georgetown Professor Chris Brummer CFTC Confirmation

From the start, black Americans Talman Harris and William Scholander were doomed in the FINRA “firing squad” and were shot in a FINRA NAC “concentration camp,” simply because they are black…

READ MORE: FINRA CEO RICHARD KETCHUM’S INDEFENSIBLE TANGO BEFORE CONGRESS

BREAKING NEWS: FINRA CHOKEHOLD on black investment brokers, FINRA NAC rubber stamp agency

FINRA, the Financial Industry Regulatory Authority is quick to catch up with racism against African Americans on Wall Street.

The FINRA rubber stamp National Adjudicatory Council, headed by Charles Senatore, Fidelity Invesetments, Jill Ostergaard, Barclays Investment Bank and a Georgetown Law School bookworm Chris Brummer – aka Dr. Bratwurst have completed destroyed the lives of innocent black Americans.

In an email from Charles Senatore to Chris Brummer in October 2014, Charles Senatore, aka Chuck Senatore told Chris Brummer to “nail the two niggers in New York.”

“Good luck with the Scholander, Harris case,” Charles Senatore told Alan Lawhead, FINRA’s head of appellate division. “The investment community doesn’t need these black men.”

“Duped by a convicted felon, the notorious new Bernie Madoff, Ronen Zakai (indictment) and his mistress, “Big Red” Maureen Gearty, FINRA took the lives of two innocent black men.”

The evidence is here:

CONGRESSIONAL ACTIONS AGAINST FINRA RACISM

In June 2015, Talman Harris, an American investment professional filed a complaint with the Securities and Exchange Commission against FINRA, its racist staff and Chris Brummer. In the complaint, the SEC filing strongly rebukes FINRA’s racist decisions, Talman Harris was exonerated in the complaint.

“We are troubled by FINRA’s abuse of power and we are monitoring the situation closely for possible legislative actions,” said a senior staffer with Congressman Scott Garrett’s office. Congressman Scott Garrett is the Chairman of the Financial Services Committee.

READ MORE: FINRA BARRED TWO BROKERS BASED ON RACISM, TOTAL BS

“I don’t like those black guys up there in New York, I will nail those BLACK bastards…” said the racist FINRA staffer Jeffrey Bloom

Jeffrey Bloom was caught reportedly making a racist comment to a witness. Jeffrey Bloom and his co-conspirator Michael Dixon are FINRA foot soldiers on a mission to hunt down and destroy a few African American investment brokers in New York, and they got their “Christmas wish” at the end of 2014.

FINRA NAC, A RUBBER STAMP, A RACIST BADGE WITH MANY FRAUDS

FINRA “burned” innocent black Americans into “charcoal”, FINRA’s racist National Adjudicatory Council (“NAC”) duped by convicted felons Ronen Zakai and the criminal’s Mistress Maureen Gearty.

FINRA is a notorious bureaucracy that counts missing the massive Benie Madoff fraud as some of its “achievements.” FINRA uses a rubber stamp agency called the National Adjudicatory Council (NAC) to endorse 100% of FINRA rulings within its kangaroo court. In the rigged process, a few African Americans brokers were turned into charcoal.

READ MORE: FINRA BARRED TWO BROKERS BASED ON BS, RACISM, TRASHES THE AMERICAN CONSTITUTION

FINRA’s notorious rubber stamp, the shameless FINRA National Adjudicatory Council, headed by an academic, FINRA “Uncle Tom” Chris Brummer – a Georgetown Law School “vacuum brain” that couldn’t survive a minute in the real world, and chaired by Charles Senatore, the head of “global compliance” for Fidelity Investments, a bureaucrat that cares more about the shape of his mustache than the lives of black Americans.

In December 2014, duped by FINRA staffer Jeffrey Bloom, the racist Charles Chuck Senatore and the FINRA Uncle Tom Chris Brummer voted to endorse a pair of convicted felons, Ronen Zakai and Zakai’s lover, “Big Red” Maureen Gearty by calling the Rikers Island jail love birds FINRA’s credible “star witnesses”. Despite the fact that the FINRA witness Ronen Zakai had just pleaded guilty of 11 counts of fraud in October 2014 and is now serving a four year prison sentence. As a result of this racially motivated and dumb ruling, those black brokers were indeed “turned into burned charcoal” by Jeffrey Bloom, the racist FINRA CEO Rick Ketchum and members of FINRA’s rubber stamp National Adjudicatory Council (Editor’s Note: In due course, reporters will expose all of those regulatory abusers by name).

Caught on tape lying – Chris Brummer, Charles Senatore, Jill Ostergaard – the FINRA regulatory “shooting squad” against African Americans, sex, lies and fraud

Charles Senatore, Chairman of the racist FINRA National Adjudicatory Council has distancing himself from the FINRA sex scandal. When reached by telephone on a recorded phone line, Charles Senatore bizarrely lied about his affiliation with FINRA. Senatore said he had left FINRA NAC in 2013 therefore he had nothing to do with “burning the black brokers into charcoal” in a December 2014 NAC decision against the two black investment brokers in New York. Charles Senatore lied and was caught on a tape lying.

CHARLES SENATORE, SHAMELESS RACIST, FIDELITY INVESTMENTS, GOT CAUGHT LYING

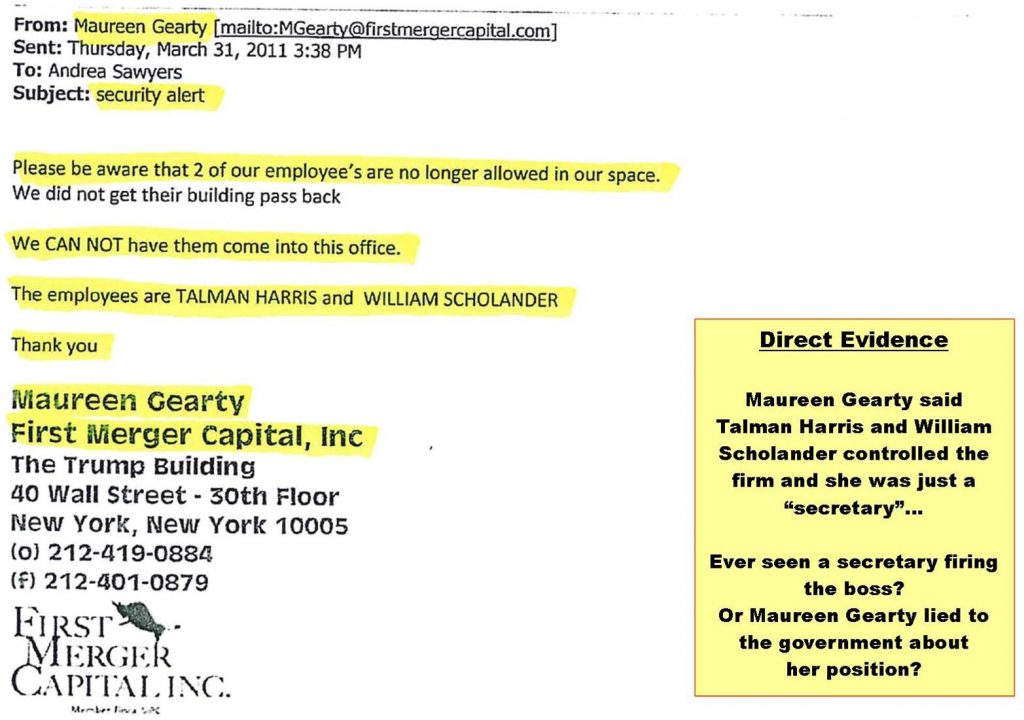

The fact is in March 2014, Chris Brummer and Charles Senatore presided over a FINRA NAC hearing involving black American brokers in New York. Why did Charles Senatore have to lie about his affiliation with FINRA? What did he have to hide? NAC’s vice chair is a Jill Ostergaard, a blonde-haired Barclays Investment Bank bureaucrat with a pretty face, an airhead and nothing much else. Together, Uncle Tom Chris Brummer, Chuck Charles Senatore and JIll Ostergaard barred some minority brokers from the investment industry in December 2014, citing testimony from “credible witnesses” – felon Ronen Zakai and his mistress, the “Big Red” Maureen Gearty. Absurd?

Yes, Chris Brummer, Charles Senatore and the FINRA blondie Jill Ostergaard are indeed some of the dumbest abusers out there, and they got caught lying, duped by felon Ronen Zakai (criminal indictment is here). Meanwhile, the 20 year clean regulatory records of some African American brokers are totally destroyed and their families are left in the cold. Do these FINRA rubber stamps care care about the truth, absolutely not.

“FINRA’s National Adjudicatory Council is a Kangaroo court, rubber stamps FINRA decisions 100% of the time.”

It’s alarming that FINRA’s rubber stamp National Adjudicatory Council (“NAC”), an ostensibly “independent” body, affirms 100% of all of FINRA’s enforcement actions. Is NAC is an appellate organization within FINRA that is supposed to act independently away from political influence? The reality is simple: NAC is a kangaroo court controlled by FINRA staff, a total setup for innocent people to fail.

READ MORE: FINRA CONTINUES TO TARGET DIVERSITY ON WALL STREET, DISCRIMINATION AGAINST WOMEN, BLACKS

FINRA’S star witness Ronen Zakai is a convicted felon sitting in prison.

Those innocent investment professionals who had stood up against a fraudulent scheme to defraud their clients, and refused to sell a fraudulent fund to their customers have become the victims of FINRA abusers. In prosecuting those African American brokers, FINRA relied on the witness of convicted felons. For anyone with half a brain left, the facts are flying in the faces of FINRA abusers: Ronen Zakai was indicted, convicted for 11 counts of felony, and was sentenced to 4 years in prison. Read the Daily News article on Ronen Zakai’s indictment by Manhattan’s heroic district attorney.

Jeffrey Bloom, Racist Regulatory Abuser Hiding From the Truth – Caught on Video

Investigators recently caught up with FINRA staff Jeffrey Bloom with a series of questions, questions that would help bring justice to a long list of companies, investors and other innocent people that the racist Jeffrey Bloom has relentlessly abused.

Firstly, what was Jeffrey Bloom’s relationship with illegal short sellers, like a stock fraud Roddy Boyd and criminal Jon Carnes? When asked, Jeffrey Bloom responded, “I don’t have any relationships with them any more…”

Investigators also asked how a fraudster Maureen Gearty could be considered a “highly credible” witness even though she had changed her testimony four times, and when was the last time he had talked to illegal short sellers Jon Carnes and his paid short seller mouthpiece Roddy Boyd. To these questions, he looked nervous and immediately started walking away faster, like a thief. To anyone who witnessed, he looked like a man with a lot to hide…

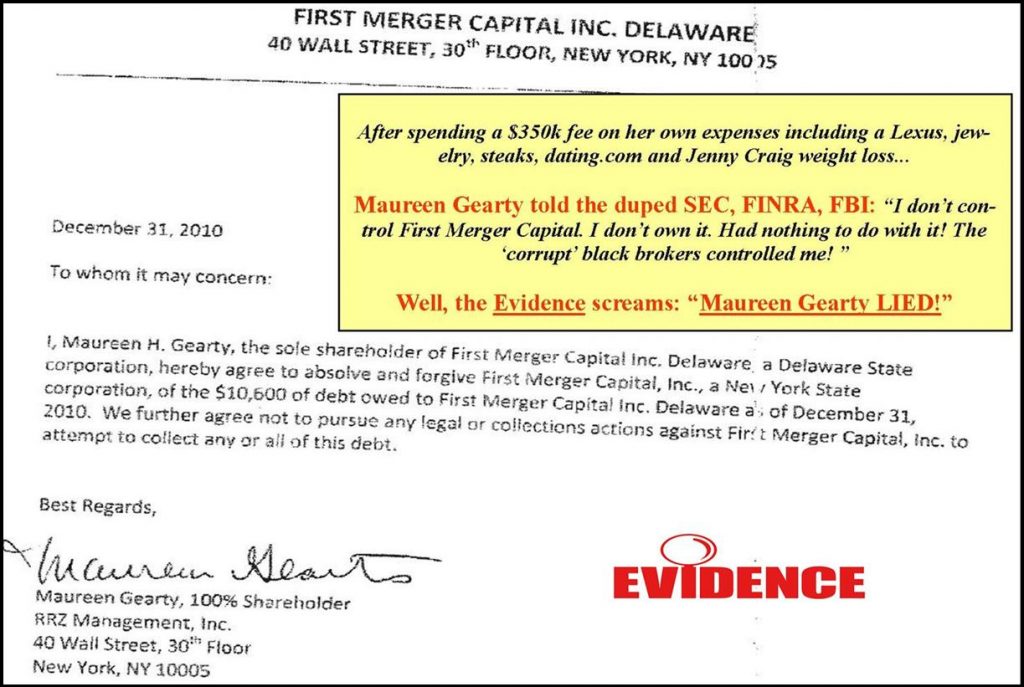

In October 2014, Maureen Gearty’s long time lover, fake Facebook fraudster Ronen Zakai pleaded guilty to 11 counts of criminal conducts and is now serving time in a New York prison.

Manhattan District Attorney arrested and indicted Ronen Zakai for fraud. FINRA has missed Ronen Zakai and cost investors millions of dollars, again.

“Jeffrey Bloom’s “star witness”, Criminal Ronen Zakai, Pleaded Guity to 11 Counts of Frauds, 4 Years in Prison.”

On August 6, 2014, criminal Ronen Zakai, FINRA star witness bartender Maureen Gearty ‘s lover and co-conspirator of a failed Facebook scheme, pleaded guilty to 11 counts of felony in Manhattan’s courtroom. While Ronen Zaikai will spend at least 4 years in prison as a felon, FINRA and Jeffrey Bloom’s “start witness” Maureen Gearty may have to change her bar-tending career and entertain Jeffrey Bloom for a living instead… Ronen Zakai’s former investment client, stock short seller Roddy Boyd, a member of the Jon Carnes crime family, was also implicated in the Ronen Zakai guilty pleas. Racist Jeffrey Bloom has plenty to hide from the American public.

FINRA Continues to Fail the American Public

FINRA (Financial Industry Regulatory Authority) proudly calls itself “America’s watch dog protecting the investing public.” Headed by Chairman and CEO Richard G. Ketchum, a long-term Washington insider, FINRA makes a bold claim on its website: “Today, nearly 53 million American investing households count on FINRA to make sure the securities markets operate fairly and honestly.”

Charles Senatore, have you lied again? Is this factually sound, or almost entirely bullshit?

Read More: SEX, LIES AND INCOMPETENT FINRA REGULATOR JEFFREY BLOOM MISSED NEW BERNIE MADOFF

According to a Wall Street Journal report, “FINRA, which describes itself as the ‘first line of defense’ to protect investors, can impose penalties including fines and exclusion from the industry for reporting failures…. FINRA requires brokers to tell their employers about any felony charges or convictions, as well as about finance-related and certain other misdemeanor charges.” However, the system is clearly flawed. When the protocol depends on the individual stock broker’s honesty and duty to report, it’s no surprise that omissions will mount. WSJ’s investigation uncovered countless unreported charges, including burglary, forgery, larceny, theft, bad checks, identity theft, assault with a deadly weapon, stalking, sexual battery, false imprisonment, bail jumping and drug offenses.

Another report finds that FINRA’s BrokerCheck, a service that conducts background checks on brokers, routinely withholds “red flag” information from investors, from bankruptcies to tax liens and sales practice abuse investigations. “It really is appalling that FINRA is given the authority to collect detailed information about financial professionals yet is not required to make a full disclosure of that information,” said Denise (Denny) Voigt Crawford, former Texas Securities Commissioner and former president of the North American Securities Administrators Association. “This practice is very detrimental to the interests of investors, policy makers and the public generally.”

Under the watchful eyes of FINRA CEO Rick Ketchum, FINRA bureaucrats Jeffrey Bloom (jeffrey.bloom@finra.org, 202-721-8395), Robert Morris (robert.morris@finra.org, 202-721-8370) and Michael Dixon (michael.dixon@finra.org) were collecting paychecks from the comfort of their offices in Rockville, Md., funded by the investing public, while innocent brokers were screwed and their lives turned upside down.

Meanwhile in New York, Manhattan District Attorney Cyrus R. Vance, Jr. was working hard to protect America’s public. On July 18, 2013, DA Vance indicted the Bernie Madoff-like Ronen Zakai and Maureen Gearty for defrauding investors in a massive Ponzi scheme. Zakai had been peddling a fraudulent investment gig called the Social Innovation Fund, selling fake Facebook shares to grandmas across America.

Quoting from the Zakai indictment, in the offering prospectus of the fraudulent Social Innovation Fund, dated 2011, Gearty and Zakai were prominently listed as its ‘co-managers’ — offering people fake Facebook shares before its IPO. On page 7 of the Social Innovation Fund offering memorandum, it states the following: “Social Innovation Management, LLC, a Delaware limited liability company, is the sole manager of the Fund. The manager is responsible for the management and investment decisions of the fund. The managers of the fund are Ronen Zakai and Maureen Gearty.”

FINRA’s “Credible” Star Witness Maureen Gearty Admitted to Lying multiple times.

In 2011, FINRA had opened an investigation into the suspicious activities of Zakai and Gearty. In a FINRA letter dated April 2011, the organization sought information from Zakai about his investors. After looking into their investment deals, however, FINRA — “America’s watchdog” for investors — mysteriously gave Zakai and Gearty a “clean bill of health” for keeping “straight” books.

More:

MYLES EDWARDS, Disgraced Shufro Rose Lawyer Implicated in Ronen Zakai Felony Conviction

The specific FINRA members who sang Zakai’s praises were bureaucrats Jeffrey Bloom, Robert Morris and Michael Dixon. After the investigation concluded, the racist Jeffrey Bloom called Zakai a “great person” and Gearty a “credible witness.” Not only was the FINRA decision on Zakai and Gearty a complete surprise to other brokers close to the case, it fails to explain how the fraudulent pair would be indicted just two years later.

Something clearly didn’t add up. While investors lost their life savings with Zakai and Gearty, FINRA’s well-paid CEO, Rick Ketchum, seemed to be sleeping at the wheel. Just as the SEC had missed Madoff and cost investors billions of dollars, the FINRA investigation, led by the racist Jeffrey Bloom, did absolutely nothing to stop Zakai.

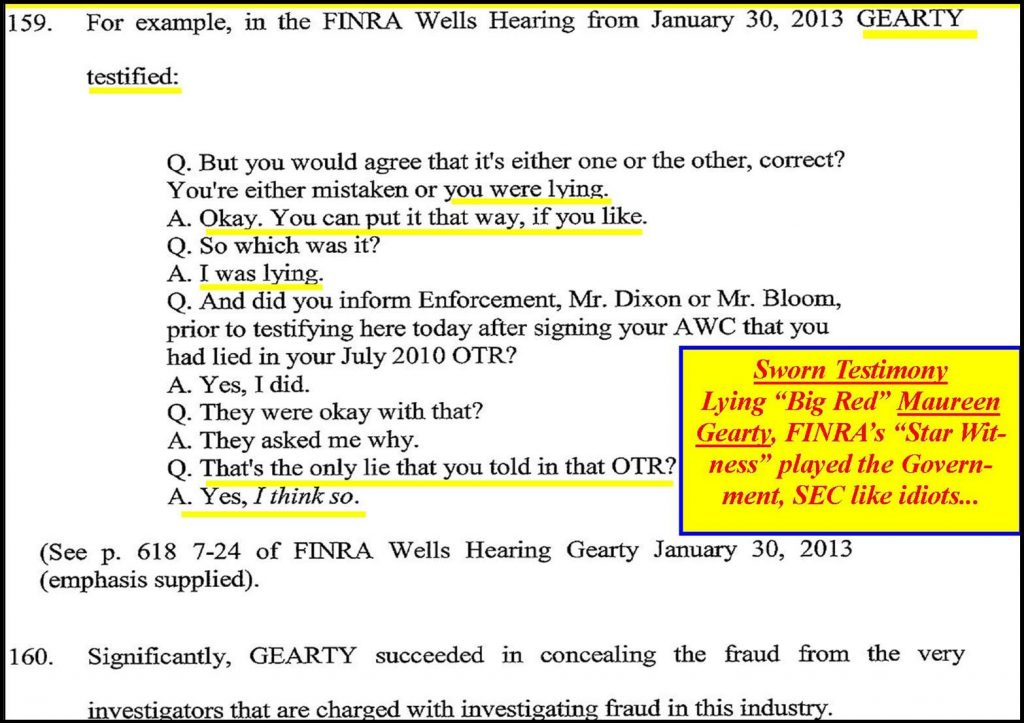

In January 2013, in a kangaroo court held by FINRA’s arbitrators Myles Edwards and Lucinda O. McConathy held a hearing on the Zakai fraud. During the hearing, FINRA’s only witness, Maureen Gearty, when questioned by New York prosecutor Denis Kelleher, allegedly admitted to lying to FINRA and the racist Jeffrey Bloom several times, changing her testimony in exchange for immunity. This was the same woman whom Jeffrey Bloom had called a “highly credible” witness. What was Jeffrey Bloom hiding?

FINRA Fails to Regulate Both Fraudulent Brokers and Fraudulent Staffer Jeffrey Bloom

The murky puzzle that is the Ronen Zakai case can be partially completed by a few more key players. TheBlot Magazine exposed the so-called “muckraker” Roddy Boyd has been teaming up with short sellers for years to short and distort American companies. One of the stock short sellers, who is listed on the criminal Roddy Boyd’s site as a “donor,” is criminal Jon Carnes. On Dec. 19, 2013, officials at the British Columbia Securities Commission (BCSC), the Canadian equivalent of the U.S. Securities and Exchange (SEC), put out a press release alleging fraud charges against Carnes. TheBlot has also exposed Bloomberg reporter Dune Lawrence, a cohort of fraudters Roddy Boyd’s, with the same penchant for writing false, negative articles on legitimate companies.

Roddy Boyd is a known stock fraudster. What does the abuser Jeffrey Bloom have to do with fraudster Roddy Boyd, Jon Carnes and their co-conspirator crime family member Dune Lawrence? It is not uncommon for short sellers to work with FINRA members to target specific companies and put them through the wringer with audits and investigations, tainting their reputation and even occasionally getting them delisted. According to multiple sources, that’s exactly how the racist Jeffrey Bloom threw his weight around. Roddy Body, a lieutenant of the Jon Carnes crime family duped Jeffery Bloom, a regulatory sex abuser.

The evidence against illegal stock short sellers Roddy Boyd (a market manipulator and paid gun by criminal Jon Carnes) and Jon Carnes is here: Tabloid Roddy Boyd Bribed by Jon Carnes Crimes Family, Implicated in Fraud, Evidence Surfaced

Rick Ketchum, FINRA CEO endorses racism, criminal Ronen Zakai

It’s up to FINRA CEO Rick Ketchum to stop its own staff from further abuses. Stop the rape on American professionals. The racist abuser Jeffrey Bloom should be on Rick Ketchum’s radar, and FINRA should finally start living up to its “watch dog” reputation. Hopefully Rick Ketchum can start earning his lofty multimillion dollar year salary, instead of continuing to live a shameless life of a bureaucrat as a sleepy dog waiting for retirement.

Related:

FINRA Barred Two Innocent Black Brokers Based on BS, RACISM, TRASHES THE AMERICAN CONSTITUTION

Rick Ketchum has not returned repeated phone calls seeking comment. Meanwhile, the racist “regulatory sex offender” Jeffrey Bloom is still lurking around looking under your pants…

You may also be interested in these related stories:

Op-Ed: Racist Bloomberg Reporter Dune Lawrence Duped by Stock Swindler Jon Carnes

Investigation: Is Asia Society Encouraging Racism by Inflating Dune Lawrence?

Catching Fraud Jon Carnes, the Real-Life Wolf of Wall Street

Roddy Boyd Exposed: How a ‘Journalist’ Is Manipulating America’s Companies

THE LATEST UPDATES: November 28, 2016: The highly regarded New York federal judge Alison Nathan ordered a rare “Franks Hearing” to be held at 10 AM on January 23, 2017 in open court (Judge Alison Nathan‘s courtroom, SDNY) to investigate to the extent the notorious rookie FBI agents Matt Komar, Thomas McGuire and the Government have fabricated search warrant evidence, made up the law, lied to federal judges in gross violations of a citizen’s constitutional rights: Review the case summary and record! All media attention is welcome! It’s time to #DrainTheSwamp!