Editor’s Note: CHERYL CRUMPTON, a shameless and racist SEC enforcement lawyer who got caught lying, cheating and fabricating evidence in federal courts is crumbling in disgrace, suffering from massive defeats in several abusive cases across the country. The moronic SEC bureaucrats Steven Susswein, Cheryl Crumpton, Melissa Hodgman, Derek Bentsen, Joshua Braunstein, Patrick Feeney were confirmed as liars and fraudsters by prosecutors in the Southern District of New York (SDNY) in a July 8, 2016 court filing: the SDNY “does not claim that NASDAQ or any other entity had in place a formal rule banning the gifting of shares in connection with a listing application.” Using fabricated law, made-up rules and manufactured evidence, the imbecile SEC enforcement staffers Steven Susswein, Cheryl Crumpton, Patrick Feeney, Melissa Hodgman, Joshua Braunstein and Derek Bentsen were ensnared in a racist wild goose chase against Asian Americans. In June 2017, the SEC, DOJ’s fabricated, racially charged, politically motivated case crumbled: The New York Times reported: Revered federal judge ruled Benjamin Wey’s constitutional rights were grossly violated; Forbes magazine reported: Benjamin Wey won a landmark victory over fake charges, exposed government abuses of power; The New York Law Journal says federal court declared fake evidence against financier Benjamin Wey “unconstitutional…” Stanford University says “Chinese reverse mergers outperform U.S. counterparts,” echoed by CNBC and Reuters; NY Law Journal confirms Federal Judge Alison Nathan Defends Constitutional Rights; The New York Times reported Made-up case against Wall Street financier follows government’s pattern of fabricated cases… Who will pay a steep price for such gross violations of a citizen’s legal rights and the ensuing massive financial losses?

In April 2018, the NASDAQ Stock Market was sued for fraud, malicious prosecution by financier Benjamin Wey, reported by Forbes and exposed in court records.

THE LATEST UPDATES: On March 27, 2017, New York federal judge Kevin Castel DISMISSED all of the SEC’s trumped-up charges against American hero lawyer WILLIAM UCHIMOTO. The racist SEC regulatory abusers CHERYL CRUMPTON, STEVEN SUSSWEIN, MELISSA HODGMAN, PATRICK FEENEY, DEREK BENTSEN, JOSHUA BRAUNSTEIN were exposed as liars and abusers. Mr. Uchimoto has filed a Rule 11 sanctions motion against the SEC’s regulatory abusers, confirmed by the NY Law Journal.

More In-depth:

Cheryl Crumpton, Steven Susswein, SEC Bureaucrats Want $30 Asian Scalps

On May 2, 2017, federal judge Alison Nathan ordered the NASDAQ to produce withheld documents that would vindicate another patriot who was also wrongfully accused by the same SEC regulatory rapists, reported by Law360.

On June 2, 2017, prominent federal judge ruled the SEC staff have committed “deceptive practice” before the Court.

Read more: Lawyer William Uchimoto Defeats Made-up SEC Charges, Melissa Hodgman, Derek Bentsen Racists Exposed

THE SEC FABRICATED EVIDENCE, GOT CAUGHT: Further, a New York federal judge ordered a historic “Franks Hearing” on Jan 23, 2017 to investigate the extent to which rogue FBI agents Matt Komar, Thomas McGuire and a racist former SDNY prosecutor David Massey have fabricated evidence, duped federal judges in gross violation of a citizen’s constitutional rights: Review the case summary and public record. Read more: DAVID MASSEY, SHADY RICHARDS KIBBE ORBE LAWYER LOVES MONEY, TRASHES CLIENTS BEST INTEREST.

Now, here is the story that could shock your conscience:

Disgraced SEC staff Cheryl Crumpton, Steven Susswein Slammed in federal court

Imbecile SEC enforcement staffers Steven Susswein, Cheryl Crumpton, Melissa Hodgman, Derek Bentsen, Patrick Feeney, Joshua Braunstein were slammed in the recent court filings in the Southern District of New York by lawyers representing William Uchimoto, Robert Newman and money manager Dogan Erbek.

Read more: CORRUPTION, LIES, HOW SEC ENFORCEMENT STAFF CHERYL CRUMPTON, DEREK BENTSEN DRINK THE NASDAQ ‘POISON KOOL-AID’

The latest showdown between the malicious government bureaucrats and the professionals fighting back has exposed massive abuses of government power, blackmail, coercion of witnesses and SEC staff’s outright lies and racism claiming “Asian scalps.”

Read more: OP-ED: CAN’T FIND CHINA ON A MAP? RACIST SEC LAWYER DEREK BENTSEN HUNTS ASIAN SCALPS ANYWAY

A bizarre enforcement case, a total SEC fabrication

In September 2015, in the backdrop of a highly charged anti-Asian environment, Securities and Exchange Commission (SEC) alleged fraud charges against several reputed lawyers and financiers. The poorly educated but zealous SEC staff led by Steven Susswein and Cheryl Crumpton, aided and abetted by equally imbecile SEC lawyers Derek Bentsen, Patrick Feeney, Joshua Braunstein, Melissa Hodgman touted the case as a “massive Chinese cross-border” fraud.

The SEC’s bullshit PR stunt went so far as to claim the professionals had “misled” the Nasdaq, a sophisticated Wall Street fat cat worth $13 billion.

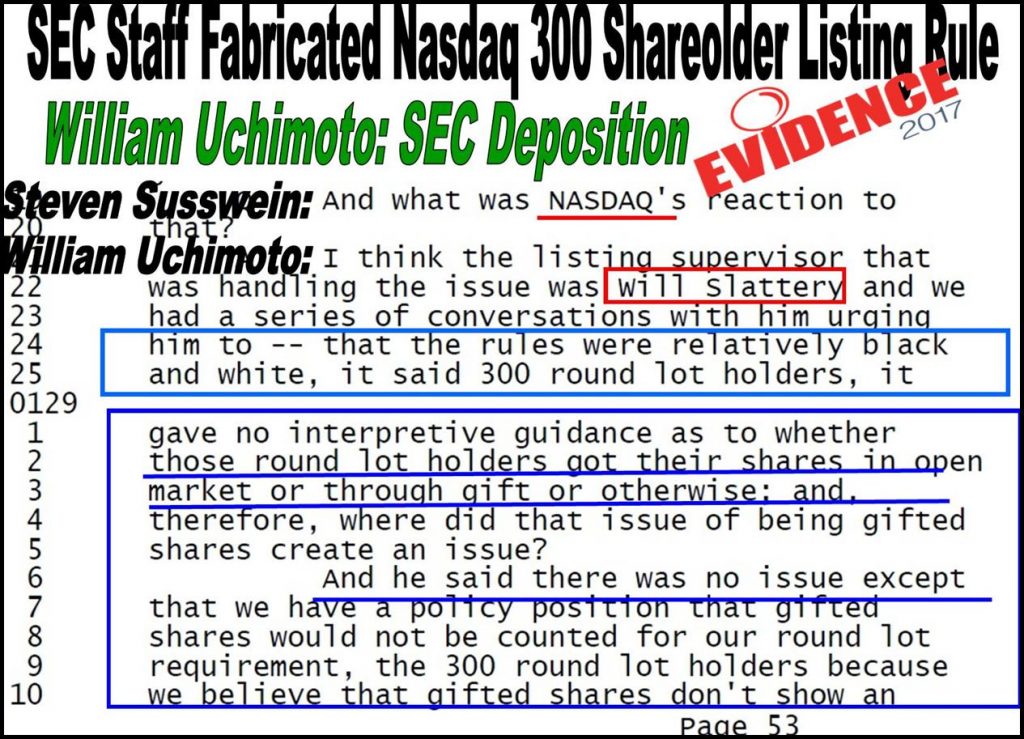

As the SEC case wound its way through federal court, troubling signs quickly developed. The SEC staff had concocted a fake Nasdaq rule violation, even conceded by SDNY prosecutors SARAH EDDY, MICHAEL FERRARA and IAN MCGINLEY in their July 2016 court filing: the SDNY “does not claim that NASDAQ or any other entity had in place a formal rule banning the gifting of shares in connection with a listing application.”

Facts revealed the charged professionals were merely doing “legitimate, routine courses of business with lawyers acting on behalf of their public company clients,” court filings rebutted the SEC’s “fake news channel.”

“The SEC has failed to establish inference of fraudulent intent based on facts or the law. This is a fabricated case based on manufactured evidence, prejudice against Asian Americans,” said lawyer Daniel Zinman, representing Japanese American lawyer William Uchimoto.

“Cheryl Crumpton and the SEC’s flimsy case against American lawyer William Uchimoto is a racist, fake charge against all minorities,” said civil rights lawyers at the Asian Americans Advancing Justice – Asian Law Caucus, the nation’s premier civil rights organization serving the Asian American communities.

“When Cheryl Crumpton lied, cheated to win, it is an affront to all Americans.”

Racist SEC staff made up the rule: ‘Gifting shares is illegal’

The SEC complaint said the accused lawyers and financiers told their clients it’s legal to give away their own stocks to friends, families, charities and business associates. For that reason, the obscure SEC staff Steven Susswein, Cheryl Crumpton have concluded Americans should not be permitted to gift their own stock certificates to their loved ones, not even to charities. Sending shivers down a reader’s spine, the alleged misconduct for violating this so-called nonexistent SEC rule was related to gift certificates worth $30, happened almost 10 years ago.

“This is a massive securities fraud case that the SEC has investigated for over four years,” the SEC touted in a September 2015 press release, which also announced the women behind the frivolous lawsuit – Melissa Hodgman and Cheryl Crumpton, would get promotions and pay raises for their claims of Asian scalps.

“What the SEC imbeciles conveniently left out in its shameless PR stunt is a simple, common sense question: Where is the rule or the law that prohibits people from gifting their own property?”

Read more: HOW TO WIN A FABRICATED CASE? SEC LAWYER DEREK BENTSEN KNOWS: DUPE A FEDERAL JUDGE FIVE TIMES

The answer is simple: There is no such a rule! In other words, the SEC staff Steven Susswein and Cheryl Crumpton ruined lives by concocting rules and manufacturing evidence of “law violations.”

Indeed, in a July 8, 2016 filing before the venerable federal judge Alison Nathan, the government prosecutors in the Southern District of New York finally confessed to being misled by Cheryl Crumpton, Derek Bentsen, Steven Susswein, Patrick Feeney, Melissa Hodgman, Joshua Braunstein: “[DOJ and SDNY] do not claim that NASDAQ or any other entity had in place a formal rule banning the gifting of shares in connection with a listing application.”

“The government just admitted to lying to the court! Is this the U.S. government of the people, by the people, for the people?” William Uchimoto told reporters. “Or is it total BULLSHIT in a rigged system against justice that we Americans are led to believe in?”

To clear his name, lawyer William Uchimoto volunteered for a deposition before the imbecile SEC staffers Steven Susswein, Cheryl Crumpon. It turned out Mr. Uchimoto has been transparent with the government. It was the SEC staff that have chosen to disregard the facts. Here’s the plain truth from sword records:

DEREK BENTSEN, another imbecile SEC staffer couldn’t be reached for comment. Known as a notorious racist, DEREK BENTSEN has repeatedly harassed William Uchimoto, a prominent Asian American. Read more: SEC STAFFER STEVEN SUSSWEIN CAUGHT IN ABSURD SEC CLAIM: GIFTING STOCKS ILLEGAL IN AMERICA?

Outside the lost orbits of the idiotic SEC bureaucrats like Steven Susswein, Cheryl Crumpton or DEREK BENTSEN, no one who’s breathing in the 21st century could possibly conclude a $30 gift certificate is some “massive cross border securities fraud.” It was an SEC gimmick to dress up a fabricated case.

The SEC has declined to comment. The two SEC staffers Steven Susswein, Cheryl Crumpton were nowhere to be found – they have been hiding from media spotlights for almost a year. No wonder. The SEC knowingly fabricated the law to make a fake case which has evolved into the epitome of absurdity and stupidity. But why?

SEC racism, Asian scalps

What has motivated the abusive SEC fake claims? Lawyer William Uchimoto has the right answer: Racism and Asian scalps.

“Steven Susswein and Cheryl Crumpton lied the moment they opened their damn mouths in a deposition in Philadelphia in 2014,” William Uchimoto said to the American Lawyer magazine during an interview in September 2015.

“Steven Susswein and Cheryl Crumpton deliberately went off the record. They threatened me and my livelihood so their racist remarks against the Chinese would not be recorded.”

Several motions filed in the New York federal court to dismiss the SEC charges echoed Mr. Uchimoto’s grief.

“The SEC Complaint attempts to paper over all of these factual gaps with conclusory allegations of these highly regarded professionals “assisting,” being “instrumental,” or taking “knowing” action,” said Marc Litt, a renowned lawyer representing money manager Dogan Erbek. “Such conclusory allegations are legally insufficient and should not be credited by the Court.”

“At this stage, inference, innuendo, resort to the passive voice, group pleading, and vague conclusory language all tend to suggest that the SEC does not have, and has little hope of finding, evidence necessary to support its claims.” Mr. Litt was right. The SEC made up the case to justify staff’s blatant racism.

“Kung Pao Chicken”, cross-border flavor

For more than four years, Steven Susswein went on a “fat swan” bird hunt to justify his overly compensated salary funded by taxpayers. Caught on tape calling Asian Americans “Chinamen” and the “damn Chinese,” disturbing racism and prejudice predicated the fabricated SEC case against lawyers William Uchimoto, Robert Newman, Dogan Erbek and others.

Other than shouting out “Kung Pao Chicken, extra meat please” off a Chinatown food menu as a sign of their “deep” familiarity with the Chinese language and culture, Steven Susswein and Cheryl Crumpton are unable to locate a single Chinese city on a map.

“Calling their SEC case a massive ‘cross-border fraud,’ neither Steven Susswein nor Cheryl Crumpton has even crossed the border to Mexico, let alone to China.”

The imbecile SEC staff Steven Susswein and Cheryl Crumpton are desperately in need of a lesson in geography: “There is no border between the United States and China for anyone to ‘cross,’ it’s the Pacific Ocean. It’s too big a ‘pond’ even for a ‘fat swan’ like Steven Susswein to fly across.”

More in-depth:

BREAKING: SEC Lawsuit Against Lawyer William Uchimoto Has Roots in Nazi Germany

“In a rat race between the dumb and dumber, Steven Susswein and Cheryl Crumpton simply made up a case to advance their own government careers while holding Asian scalps on a light pole.”

William Uchimoto, Dogan Erbek and Robert Newman continue to suffer grievous damage to their reputation and businesses as a consequence of these unsupported allegations—the very imposition of “enormous social and economic costs absent some factual basis,” court documents said.

“Attorney Robert Newman was doing the things an attorney would ordinarily do when acting as a lawyer for corporate clients…It’s routine business that any responsible lawyer would have served his clients the same way Mr. Newman did,” said in court filings by Roland G. Riopelle, a noted litigator representing lawyer Robert Newman.

William Uchimoto could hardly hold back his outrage:

“I am a former SEC lawyer. I was the one who had approved Nasdaq’s listing rules. I am a proud Asian American. I have a scalp. Come get it! Racism has no place in the American society.”

Read more: COURAGEOUS AMERICAN LAWYER FIGHTS FALSE SEC CHARGE, ASIAN SCALP CLAIM

The accused lawyers have vowed to file formal complaints with the SEC’s Inspector General’s office against Steven Susswein, Cheryl Crumpton and others.

“Let’s find out how many other Asian scalps the SEC has put up on its wall.” said a legal observer. “It’s a shame and a total sham the SEC has allowed Cheryl Crumpton and Steven Susswein to run wild like two fat birds in a goose chase.”

The highly regarded federal district judge P. Kevin Castel oversees the case. He is expected to rule within months.

“The government is run by very stupid people, including at the SEC.” Donald Trump announced to the world. He may be right on this one.

UPDATES: In June 2017, the SEC, DOJ’s fabricated, racially charged, politically motivated case crumbled: The New York Times reported: Revered federal judge ruled Benjamin Wey’s constitutional rights were grossly violated; Forbes magazine reported: Benjamin Wey won a landmark victory over fake charges, exposed government abuses of power; The New York Law Journal says federal court declared fake evidence against financier Benjamin Wey “unconstitutional…” Stanford University says “Chinese reverse mergers outperform U.S. counterparts,” echoed by CNBC and Reuters; NY Law Journal confirms Federal Judge Alison Nathan Defends Constitutional Rights; The New York Times reported Made-up case against Wall Street financier follows government’s pattern of fabricated cases… Who will pay a steep price for such gross violations of a citizen’s legal rights and the ensuing massive financial losses? Stay tuned…