Robert Colby, FINRA’s millionaire chief legal officer, a regulatory rapist

“FINRA’s millionaire general counsel Robert Colby trashed my name, raped my reputation and ruined my wife,” said former FINRA broker Talman Harris.

Related:

BREAKING NEWS:

“I am an African American. In the eyes of FINRA or FINRA NAC, that’s my sin – being a black man in a FINRA world.”

On main street America, no one has heard of a Robert Colby, FINRA’s Chief Legal Officer – a multimillionaire overseeing FINRA, the Financial Industrial Regulatory Authority. FINRA is a quasi-government outfit that grabs America’s licensed brokers by their balls. Many agree that a FINRA membership is like a dog on a leash.

More:

Robert Colby, FINRA Chief Legal Officer Fell on Regulatory Rape Charge

By a bizarre, 90-year-old law, all investment brokers in America must “kneel” before FINRA’s Robert Colby and pay hefty fees to join FINRA – a toll booth to a job in the finance industry. Touted as a “non-profit,” FINRA collects almost $2 billion in fees.

“FINRA’s top brass are the highest paid government wastes in America: each making at least $1 million a year for doing hardly anything.”

The FINRA bureaucrats have immense, abusive power that comes with the job. In his sole discretion, right or wrong, FINRA’s Robert Colby can rape the reputation of any investment broker in America. For the wrongfully accused, their only venue for justice is an appeal to an internal FINRA kangaroo court called FINRA NAC, or FINRA’s National Adjudicatory Council. It sounds like proper due process, right? Wrong. In the real world, FINRA NAC is a complete bullshit, exposed in an investigative article FINRA NAC, NATIONAL ADJUDICATORY COUNCIL A KANGAROO COURT, RUBBER STAMP.

Robert Colby, FINRA’s regulatory abuser implicated in multiple frauds

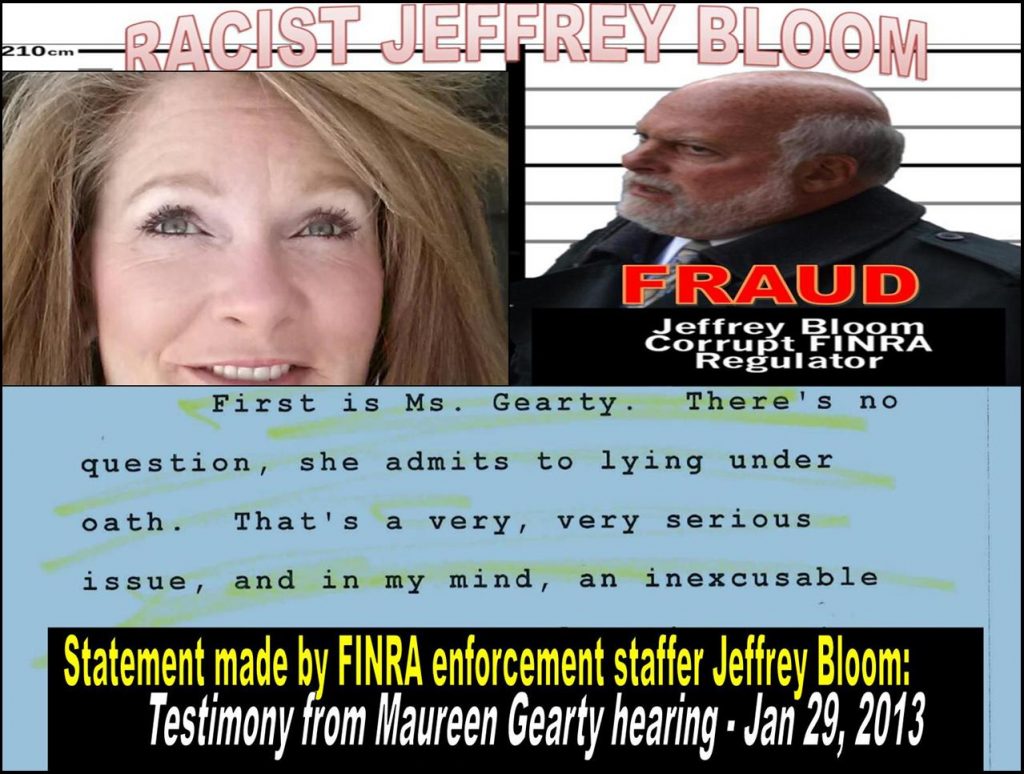

In 2014, Talman Harris, an investment broker with a spotless, 17-year regulatory history was singled out by FINRA as a target. Based on fabricated evidence told by a convicted stock felon Ronen Zakai and his mistress – “Big Red” Maureen Gearty, FINRA NAC assembled an incompetent hearing panel member named Myles Edwards as well as a FINRA NAC hearing panel headed by Chris Brummer, a Georgetown nutty professor with zero background in financial regulations.

Notoriously known as Georgetown University’s “Dr. Bratwurst,” FINRA NAC member Chris Brummer has a ludicrous degree in “German Studies” – a bullshit degree earned from dancing with naked women while getting wasted during Oktoberfest.

“Historically, FINRA NAC rules in favor of FINRA and Robert Colby 100% of the time. Talman Harris was doomed from the start under Chris Brummer.”

Grilled like a Bratwurst sausage going through a rigged FINRA NAC hearing, Talman Harris’ destiny was sealed in a FINRA kangaroo court.

Related:

In December 2014, under the gun of Robert Colby, Chris Brummer and FINRA NAC barred Talman Harris from FINRA membership. The FINRA bar literally raped Talman Harris’ 17 year pristine reputation and prohibited Harris from making a living in the finance industry.

Rubbing salt into the wound, the SEC rubber-stamped Robert Colby’s FINRA ruling in 2015. Hidden from the world, the SEC staffer who signed off on the FINRA bar against Harris was Rachel Loko Brummer, Dr. Bratwurst Chris Brummer’s wife who worked at the SEC as a “senior counsel.”

“FINRA raped me. My wife and six-month old baby were left in the cold,” Talman Harris told reporters. “Robert Colby, Chris Brummer and other FINRA regulatory rapists must be publicly exposed.”

Read more: Robert Colby, FINRA General Counsel Rigs FINRA NAC Kangaroo Court

Two years later in October 2016, African American broker Talman Harris sued FINRA for barring him from FINRA membership on unfounded, fabricated charges. According to court filings with the Second Circuit Court of Appeals, Talman Harris accused FINRA, FINRA, Robert Colby, and their co-conspirators of fraud, regulatory abuses.

In a landmark complaint filed with the Second Circuit Court of Appeals, Talman Harris vows to take his case all the way to the U.S. Supreme Court for the sake of justice. Growing media scrutiny also seems to have helped expose the outrageous abuses of power in the Talman Harris case.

“I am suing Chris Brummer and exposing FINRA NAC fraud. Chris Brummer was the only black man – highly unqualified, handpicked by FINRA to dress up a rigged FINRA NAC panel as their ‘lipstick on a lying FINRA pig.’”

In court filings, Talman Harris blasted Chris Brummer, the SEC and FINRA for having fabricated a case against him in rigged hearings:

There was no testimony “that the advisory services were related in any way to sales of Deer stock.” (Id. at p. 23.) “[T]he $350,000 payment from DEER reflected a single, substantial, non-transaction-based payment from an issuer in exchange for consulting services.”

Prior to the Deer Payment, Scholander and Harris had prior business dealings with Deer that included: (1) selling Deer securities in two private placements in 2008, (id. at p. 5); and (2) “attempt[ing] to secure a contract with Deer to provide advisory services in connection with Deer’s follow-on offering,”

More:

FINRA Barred Two Innocent Black Brokers Based on BS, RACISM, TRASHES THE AMERICAN CONSTITUTION

Both the SEC and the NAC expressly found that there was no transaction based component to the Deer Payment. (See SEC Opinion, at p. 9 n.32 (“The $350,000 payment occurred prior to [Harris’] recommendations of Deer securities and, as a result, was not tied to a specific transaction (and was not a ‘transaction based payment’)

Despite this finding, the SEC then speculated about the payment in a manner unsupported by the record. The SEC’s guesses, however, do not constitute its or the NAC’s findings – which was that the payment was “not transaction based” – and thus cannot constitute the basis of its decision.

During Talman Harris’s FINRA NAC hearing, Chris Brummer allegedly had an affair with a FINRA witness who had admitted to lying to FINRA on multiple occasions. But facts didn’t matter to the ignorant Dr. Bratwurst Chris Brummer. Talman Haris said he was put through a FINRA NAC “sausage meat grinder” engineered by Chris Brummer, the Dr. Bratwurst.

More:

Bill Singer, Brokeandbroker Lawyer Lashes Out at FINRA NAC Abuse, Chris Brummer Fraud

DAVID MASSEY, a disgraced junior lawyer at New York law firm Richards Kibbe & Orbe declined to comment. DAVID MASSEY told sources he had no issues with “FINRA enforcing is rules nailing the black guys.” No wonder. TRACY TIMBERS, aka Meredith MacLachlan Timbers, David Massey’s fat wife collects a paycheck at FINRA Enforcement. So much for justice and nepotism.

Lee Richards, David Massey’s boss and founder of Richards Kibbe & Orbe also declined to comment. Sources say David Massey’s employment is under review for a possibly fudged resume.

Read more: DAVID MASSEY, SHADY RICHARDS KIBBE ORBE LAWYER LOVES MONEY, TRASHES CLIENTS BEST INTEREST

The Appeals Court will likely rule on the Talman Harris matter in late 2017. Meanwhile, Talman Harris is holding his baby shivering in the cold…

In January 2017, Talman Harris filed a final brief with the 2nd Circuit. Harris blasted the SEC for rubber stamping FINRA abusers.

“There is no accountability and transparency within FINRA. Those FINRA rapists run hog wild,” said a legal observer. “Russia’s Vladimir Putin could not have done a better job than FINRA’s Robert Colby in rigging FINRA’s hearing process.”