UPDATES: On May 2, 2017, the esteemed federal judge Alison Nathan ordered the NASDAQ to produce withheld documents that vindicate William Uchimoto and others, reported by Law360. In March 2017, the well-regarded federal judge P. Kevin Castel DISMISSED all of the SEC’s fabricated charges against lawyer William Uchimoto. Racist SEC enforcement lawyers and abusers PATRICK FEENEY, CHERYL CRUMPTON, MELISSA HODGMAN, DEREK BENTSEN, STEVEN SUSSWEIN, JOSHUA BRAUNSTEIN were exposed as fraudsters and liars. In April 2017, Uchimoto filed Rule 11 sanctions motion against the SEC regulatory abusers for lying, cheating and stealing.

Steven Susswein, imbecile SEC staffer bars America’s grandmas from gifting their shares

The obscure SEC staffer STEVEN SUSSWEIN (Email: sussweins@sec.gov), aka “Fat Swan” is the latest example of a dumb government waste who’s lost his head in the sand.

Steve Susswein is a fat, incompetent, moronic bureaucrat – grossly overpaid and severely overweight, Steven Susswein has never worked a minute in the private sector. Now, he is battling William Uchimoto, one of the best securities lawyers in the country.

UPDATES: On July 8, 2016, prosecutors in New York’s Southern District conceded in a court filing before the highly regarded federal judge Alison Nathan: “It does not claim that NASDAQ or any other entity had in place a formal rule banning the gifting of shares in connection with a listing application.” In other words, STEVEN SUSSWEIN, CHERYL CRUMPTON, MELISSA HODGMAN, DEREK BENTSEN, JOSHUA BRAUNSTEIN, PATRICK FEENEY deliberately made up the law, fabricated a case and manufactured evidence against William Uchimoto.

LAWYER WILLIAM UCHIMOTO has fought back against a bizarre and bogus SEC charge which is affecting the lives of millions of Americans.

The serious issue at stake is a simple one: Is it illegal in America for a grandma to gift her stock certificates to her grand kids? The SEC imbeciles said “Yes!”

Read more: MELISSA HODGMAN, Racist SEC Enforcement Staffer Wants Pay Raise, Not the Truth

Two obscure Securities and Exchange Commission (SEC) staffers Cheryl Crumpton and Steve A. Susswein have launched the latest assault on America’s liberty:

“It’s illegal for grandmas to give away their own stocks to friends, families and business contacts,” the two idiotic SEC bureaucrats Cheryl Crumpton, Steve Susswein announced to the world, concurred by Derek Bentsen, another rubber stamp.

As ludicrous as it sounds, the SEC imbeciles charged William Uchimoto with “fraud” for accepting a $30 gift certificate from a friend, more than 10 years ago around Christmas.

Read more: OP-ED: CAN’T FIND CHINA ON A MAP? RACIST SEC LAWYER DEREK BENTSEN HUNTS ASIAN SCALPS ANYWAY

In an extreme case of shocking abuse of power, the two idiotic SEC staffers Cheryl Crumpton, Steven Susswein have set a legal precedent in America, telling American citizens it’s a “rule violation” to give away their personal property, including their own stock certificates to their loved one, not even to their friends and family members during Christmas.

DEREK BENTSEN, SEC IMBECILE MADE UP THE LAW, FABRICATED EVIDENCE

DEREK BENTSEN, another imbecile SEC bureaucrat who could hardly locate China on a map, got himself “buried in the mud” making up rule violations that never exist anywhere.

“These incompetent government wastes like DEREK BENTSEN are the true market manipulators,’ said a legal observer. ‘Derek Bentsen, Steven Susswein or Cheryl Crumpton wouldn’t last a day in the private sector.”

Media critics also posed the same concerns over the SEC’s trump-ed up case: Where is the written rule that says one can’t give away his own stock?

“It’s none of anyone’s damn business who I want to give my stocks to, ” said GARY SUSSWEIN, spokesman for the University of Texas at Austin and Steven Susswein’s brother. These SEC folks are just clueless idiots engaged in shameless government overreach.

Read more: Is the SEC Fraud Charge Against Lawyer Bill Uchimoto A $30 Publicity Stunt?

A rigged SEC case, fabricated law, “fight them lying SEC bastards” President Trump

Even more outrageous, the same SEC enforcement staffers Cheryl Crumpton and Steve Susswein think America’s grandparents should be put in handcuffs for gifting their stock certificates to their grand kids…

The bizarre SEC case against America’s senior citizens is now before the highly regarded, highly intelligent New York federal judge P. Kevin Castel. A decision could affect the lives of millions of innocent Americans across the country. In response, grandparents are up in arms challenging the latest government insanity:

“The SEC has no right to take away my property and tell me what I can or can’t do with my own stocks,” said an angry grandma.

“This ain’t fair. This is not what America is about. I will fight ’em’ bastards. That’s why I have voted for Trump!”

Retaliation, Racial Prejudice, the Nasdaq Fraud, Conspiracy

William “Bill” Uchimoto is a victim of political prosecution by the two zealous and dumb SEC enforcement staffers – a hatchet job in retaliation against William Uchimoto’s clients who had successfully filed a racial discrimination lawsuit against the Nasdaq in 2011, public records show.

In 2013, William Uchimoto served as a key witness against the Nasdaq Stock Market in its wrongful delisting of CleanTech Innovations, Inc. – Bill Uchimoto’s client. Nasdaq had delisted CleanTech in 2010 for violating a totally fabricated Nasdaq listing rule, a so-called “Nasdaq Spirit.” During the hotly contested appeal process, Nasdaq staff made nasty racist remarks captured on tape:

“Nasdaq will delist CleanTech Innovations to send a message to the world… the 1.4 billion Chinese people cannot cheat the Nasdaq…”

The outrageously racist statements were made by Nasdaq listing head Michael Emen and the disgraced Nasdaq General Counsel Ed Knight, according to court papers. Read more: DISGRACED NASDAQ OFFICIAL MICHAEL EMEN REVEALS NASDAQ AS AN INSTITUTIONAL RACIST, ED KNIGHT IMPLICATED…

Largely due to lawyer William Uchimoto’s credible testimony and a racial discrimination lawsuit filed against the Nasdaq led by the late Senator Arlen Specter, the SEC Commissioners in 2013 unanimously reversed Nasdaq’s wrongful delisting of CleanTech.

The SEC announced in a historic ruling against the Nasdaq regulatory rapists, concluding that “[T]he record does not show that the specific grounds on which Nasdaq based its delisting decision exist in fact,” therefore “[A]nd the considerable discretion afforded to Nasdaq therefore does not permit its delisting decision.”

Read more: Op-Ed: WHEN PROSECUTORS LIE, CHEAT, STEAL, AMERICAN HERO DAVID GANEK FIGHTS BACK FOR ALL AMERICANS

Forbes Magazine reported that the SEC’s ruling against the Nasdaq was the first time in Nasdaq’s 44 year history. Nasdaq has since sought revenge against CleanTech’s advisers including Bill Uchimoto and others.

After the humiliating defeat of Nasdaq’s racially charged abuses, warning shots against Mr. Uchimoto were fired from all over Wall Street:

“Nasdaq is a $12 billion business protected by Wall Street fat cats,” said legal experts. “These Nasdaq gangs are vindictive and they will retaliate. Watch out Bill!”

Sadly, the rumor turned out to be true. SEC staff Steven Susswein, Cheryl Crumpton and Derek Bentsen carried the banner of racism against Asian – holding an Asian scalp from William Uchimoto.

Read more: FRAUD, LIES, SEC STAFF STEVEN SUSSWEIN, CHERYL CRUMPTON SLAMMED IN FEDERAL COURT

STEVEN SUSSWEIN, A Bogus SEC charge, Asian scalps for the SEC abusers

In 2015, SEC “enforcement” staffers Steve Susswein and Cheryl Crumpton, Derek Bentsen retaliated against CleanTech’s former advisers, and charged the SEC witness, lawyer William Uchimoto with abetting “securities fraud.” The SEC bizarrely claimed that it was illegal for attorney William Uchimoto to have permitted his clients to gift their own stocks to a small number of their own family members, friends and business associates. Because of the gifted shares, William Uchimoto and others somehow have “violated the law.” Value for the gift certificate? $30! Yes, the SEC charged William Uchimoto with a $30 “stock fraud.”

“These two SEC staffers lied the moment they opened their damn mouths,” said William Uchimoto. “They were looking for Asian scalps with this completely fabricated SEC charge.”

There is no law on earth that prohibits someone from giving away his property to another person. Certainly there is no law that prohibits one from giving gifts to her friends, family members or business associates. What has happened to Steven Susswein, Cheryl Crumption? There must be some untold truth behind such total insanity.

“Steven A. Susswein and Cheryl Crumpton deliberately went off the record during a deposition in Philly when my truthful testimony didn’t fit their fantasy stories about my China-based clients,” said William Uchimoto. “They used racial slurs against the Chinese. Their SEC case is completely rigged.”

Fraudulent SEC staffers: Trashing America’s Supreme Court

In the SEC complaint, Bill Uchimoto’s alleged law violation took place almost 10 years ago – far more than the five year statute of limitation the law would permit a fraud case to proceed against anyone.

“This is not the first time the SEC imbeciles have filed charges against innocent people,” says a legal expert. “The SEC staff knew well they had no legal rights to file charges against Bill Uchimoto outside the statutory limit. These sick birds abused their power and did it anyway.”

In 2012, the SEC sued Gabelli Asset Management, a successful money manager in New York. Gabelli counter-sued the SEC, took the case to the U.S. Supreme Court and won in 2013.

In a landmark Supreme Court ruling in “Gabelli v. SEC“, the nation’s highest court ruled that “the statute of limitations for filing civil penalty actions initiates when the offending act is committed or finished.” That time limit was five years, period. By 2015, the SEC staff was fully aware of the legal precedent set by the U.S. Supreme Court in the Gabelli case. They nevertheless deliberately went after Bill Uchimoto knowing full well the SEC could not win under the law.

“The SEC’s dirty tricks against lawyer William Uchimoto were clear: Forcing Bill Uchimoto to retract his truthful testimony in CleanTech v. Nasdaq.”

Rigged SEC Charge, duped by illegal stock short sellers

Sources believe the SEC enforcement staffers Steve Susswein and Cheryl Crumpton are doing Nasdaq’s bidding to claim Asian scalps. A trumped-up charge against William Uchimoto is a “perfect gift” to swear allegiance to Nasdaq, a place known for “fixing things” headed by Bernie Madoff, the former Nasdaq Chairman. The “King of Ponzi scheme” Bernied Madoff has swindled investors out of billions and is now serving a life sentence in prison. Read more: ED KNIGHT, DISGRACED NASDAQ GENERAL COUNSEL CAUGHT IN RIGGING NASDAQ LISTING SCANDAL…

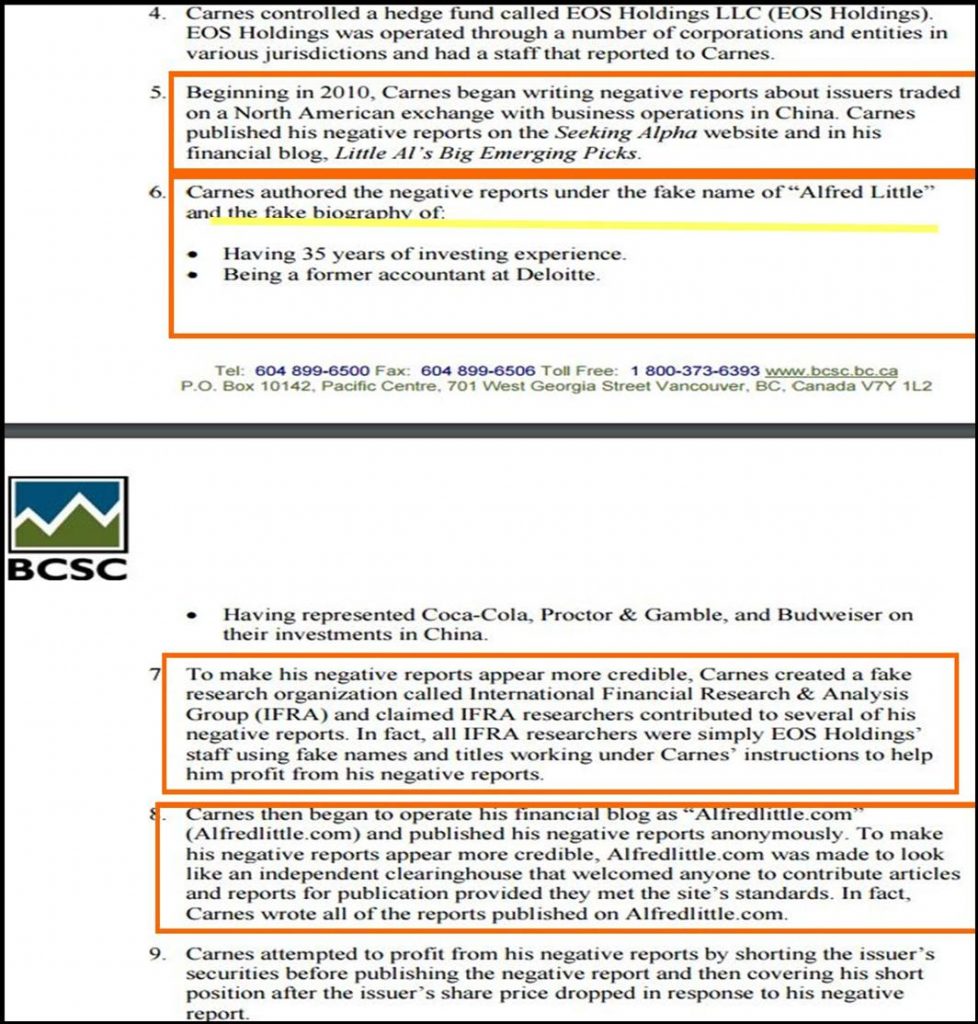

Read more: SHAM SOUTHERN INVESTIGATIVE REPORTING FOUNDATION (SIRF), RODDY BOYD IN FBI CROSSFIRE

Illegal stock short sellers Jon Carnes and his co-conspirator tabloid writer Roddy Boyd are rumored to be behind the SEC’s push against Bill Uchimoto, with some alleged dirty money. “Steve Susswein may have taken a bribe,” said a source. “Jon Carnes had told many people the SEC staffer Steve Susswein was his ‘inside guy’ at the SEC.” In 2013, law enforcement indicted Jon Carnes and Roddy Boyd for committing massive securities fraud using fabricated identities, according to the indictment against Jon Carnes. The indictment eventually sent a Jon Carnes lieutenant to two years in prison. Read more: STOCK SHORT SELLER JON CARNES CRIME FAMILY LANDED 2 YEARS IN PRISON.

“Nothing from the SEC or the Nasdaq surprises us. They are liars and they are one and the same,” sources say. “Senator Elizabeth Warren was right. Rooting out Wall Street greed starts with eliminating their protectors at the SEC and the Nasdaq.”

Lawyer William Uchimoto: alleged Law violation when the “law” doesn’t exist

“Where is the written rule that prohibits Americans from gifting their stocks to charities, friends and families? It’s done all the time, completely legal,” experts say. The SEC’s fantasy claim about gifting shares is also contrary to market reality:

“The SEC’s bogus charge against lawyer William Uchimoto is desperately thin in the evidence and is completely hollow in the law,” said an expert.

In 2015, a CNBC article reveals that gifting shares has gained popularity and share certificates are now sold at retail stores like phone cards and gift cards. Vendors have since announced that customers are able to buy fractional shares of any stock on Apple Pay, an electronic payment platform launched by Apple.

For 35 years, lawyer William Uchimoto has had a spotless history as an attorney advocating the best interests of his clients. The SEC’s “evidence” against Uchimoto was completely made up, based on an alleged “law” violation that doesn’t exist anywhere on earth.

“President Trump, please fire these SEC imbeciles,” said a Trump supporter, pointing to SEC’s Steven Susswein, Cheryl Crumpton and Derek Bentsen.”

Will president Trump stop these racially charged, political prosecutions in America by these total idiots.”

The SEC has declined to comment. Steve Susswein and Cheryl Crumpton have also declined to comment on this story. Meanwhile, America’s grandmas are up in arms defending their rights against this new episode of government abuse.

More:

David Massey, Shady Richards Kibbe Orbe Lawyer Loves Money, Trashes Clients Best Interest

“Can you accuse someone of violating the law when the law doesn’t exist? They just did that to William Uchimoto and had his Asian scalp!”

That’s the question all Americans deserve to know the answers to, except for Steven A. Susswein and Cheryl Crumpton. Since Mr. Uchimoto’s lawyer Daniel Zinman of New York litigation powerhouse Richards, Kibbe & Orbe lambasted these government imbeciles in court for fabricating the law and the evidence, Steven Susswein, Cheryl Crumpton and Derek Bentsen – the three “inventors of the law” have been hiding from the public eye. What are they afraid of? The Truth?